puerto rico tax incentive act

To bolster the manufacturing sector Puerto Rico has created an. Puerto Rico T ourism Development Act of 1993 the Puerto Rico Capital Investment Fund Act the Puerto Rico Agricultural Tax Incentives Act as amended or any other credit admitted by law to the partners related to the partnership or special partnerships activities.

Moving To Puerto Rico Your Easy Escape To Caribbean Life

The Act may have profound implications for the continued economic recovery of Puerto Rico.

. The purpose of Act 73 in Puerto Rico is to provide an entrepreneurial environment and adequate economic opportunities to continue developing a local industry that recognizes entrepreneurship as the cornerstone for the present and future economic development of Puerto Rico. Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22 to stimulate economic development by offering nonresident individuals 100 tax exemptions on all interest all dividends and all long-term capital gains. 22 of 2012 as amended known as the Individual Investors Act the Act.

Generally Act 60 encourages individual investors to become bona fide residents of Puerto Rico by exempting dividends interest and capital gains from Puerto Rico tax as long as an investor accrued those capital gains after becoming a Puerto Rico resident. Puerto Rico Act 60 formerly known as Act 20 and 22 offer outstanding tax incentives to bonafide residents over 183 days such as a flat. Add a new Section 7 to Act No.

This is the time to invest in puerto rico. 73 of 2008 known as the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing a local industry offer an attractive tax proposal attract direct foreign investment and promote economic development and social betterment in Puerto Rico. This Act was designed to help accelerate the economic recovery of Puerto Rico by attracting high net worth individuals empty nesters retirees and investors to relocate to Puerto Rico.

Citizens that become residents of Puerto Rico. The Act provides tax exemptions to eligible individuals residing in Puerto Rico. 73 of 2008 as amended known as the Economic Incentives for the Development of Puerto Rico Act the Act is the current industrial development incentives law in effect.

Individual Investors Act Puerto Rico Tax Incentives. Most popular are the Act 60 Export Services and Act 60 Individual Resident Investor tax incentives which have saved thousands of Americans untold amounts in taxes. If your business qualifies youll be.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. Understanding the Puerto Rico Incentive. 213-2000 as amended known as the Housing Units for the Elderly and Persons with.

Purpose Of Act 73 Puerto Rico. It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a resident will be exempt from tax in Puerto Rico. Act 60 Export Services.

Puerto Ricos tax incentive Act 14 is titled. On March 4 2011 Puerto Rico enacted Act No. The tax incentives enjoyed by Individual Resident Investors.

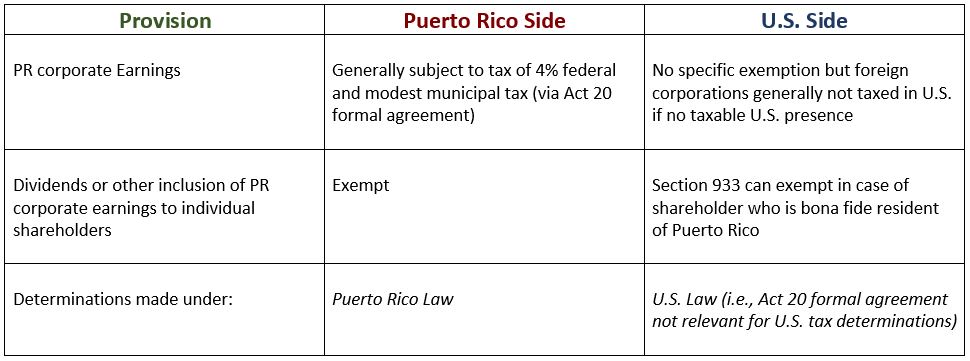

And if it the income is sourced in Puerto Rico it would escape tax in the US. 10 rows Puerto Ricos Tax Incentive Act 14. The Act provides tax exemptions and tax credits to businesses engaged in film production in Puerto Rico.

100 tax exemption from Puerto Rico income taxes on all interest. Although it is part of the United States and the same laws apply it has an independent tax system where the IRS lacks taxation jurisdiction. Move your business to Puerto Rico and pay only 4 corporate income tax.

Tax reductions on passive income and capital gains. On January 17 2012 Puerto Rico enacted Act 22 known as the Individual Investors Act. On January 17 2012 Puerto Rico enacted Act No.

Amend Section 8 of Act No. To stimulate economic growth Puerto Rico introduced generous tax incentives with Act 20 and Act 22. If you run a businessor plan to start oneyou may be interested in looking into Puerto Ricos Act 60 Export Services tax incentive.

The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. 100 tax exemption from Puerto Rico income taxes on all short-term and long-term. In short Act 22 provided 0 capital gains tax for gains you realize after moving to.

Pay only 4 corporate income tax. Pay 0 capital gains tax with the Act 60 Investor Resident Individual Tax Incentive. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business.

All you have to do is move to Puerto Rico become a bona fide resident buy a home make a small annual donation and voila all future capital gains on stocks bonds and even crypto will be tax free. Puerto Rico Tax Incentives. The Act provides economic incentives tax exemptions and tax credits to businesses engaged in eligible activities in Puerto Rico.

165-1996 as amended known as the Rental Housing Program for Low Income Elderly Persons. Puerto Ricos Act 22 tax incentives offers one of the most effective tax savings mechanisms on passive income earned from investments and capital gains making it attractive. Puerto Rico Agricultural Tax Incentives Act.

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives. Posted on June 16 2021 by admin.

Puerto Rico Act 22 officially Chapter 2 Individuals of the new Tax Incentives Code can eliminate all of that. Puerto Rico Tax Act 22. In January of 2012 Puerto Rico passed legislation making it a tax haven for US.

27 of 2011 as amended known as the Puerto Rico Film Industry Economic Incentives Act the Act to solidify its position as one of the leading jurisdictions for the production of film television and other media projects. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. 100 tax exemption from Puerto Rico income taxes on all dividends.

Move yourself to Puerto Rico and pay 0 capital gains tax. E Enter the amount claimed as credit against the income tax for withholding.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Pin On Puerto Rico Real Estate

Puerto Rico Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Stunning 4k Drone Footage Of Puerto Rico Travel Leisure Travel And Leisure Puerto Rico Puerto

Tax Incentives Incentive Puerto Rico Investing

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Cond Atrium Park Dm For More Info Apartment Dreamhome Homesweethome Dream House Estates Building

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Major Changes Brought On By The New Puerto Rico Incentives Code Upwind

Feliz Pascua A Todos Wishing Everyone A Happy Easter Http Puertoricosothebysrealty Com Luxury Real Estate Estate Homes Real Estate

Puerto Rico Home Solar And Battery Storage Pr Home Solar Panels Incentives Rebates Cost And Savings Sunnova In 2021 Solar Panels For Home Solar Panels Solar

Mayaguez Puerto Rico Architectural Gem Of The West Mayaguez Puerto Rico Puerto

Your Guide To Living In Puerto Rico Including Act 20 And Act 22 Tax Incentives Moving Tips And All The Living In Puerto Rico Florida Beaches Vacation Puerto

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

A Tax Haven Called Puerto Rico Eyes On The Ties

How You Can Move To Puerto Rico And Pay Almost Zero Tax Tax Law Solutions

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22